Planning a Crypto Exchange? 7 Things to Know Before Choosing a Development Partner

Planning a Crypto Exchange? 7 Things to Know Before Choosing a Development Partner

|

Launching a crypto exchange can be a highly profitable venture but only if it’s planned correctly. Many founders jump straight into development without understanding the long-term technical, security, and business implications. This often leads to unstable platforms, security incidents, poor scalability, and loss of user trust.

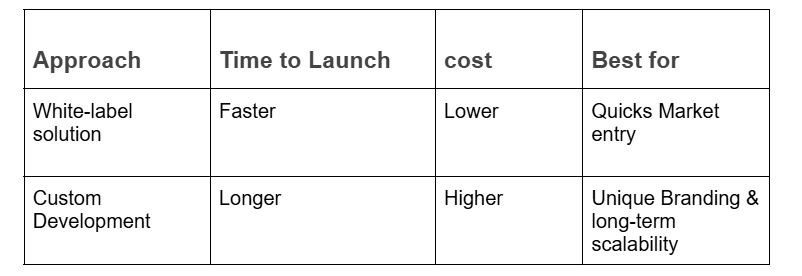

Before selecting a crypto exchange development partner, here are seven essential things every entrepreneur and decision-maker should know. 1. Decide the Exchange Model Before Anything ElseMost successful platforms today operate as centralized crypto exchanges (CEX). In this model, a single organization manages user accounts, wallets, trading operations, and fees similar to industry leading platforms such as Binance and Coinbase. Centralized exchanges are preferred by businesses because they provide: Full operational control Clear revenue models Easier compliance readiness Better scalability and customer support If your goal is long-term growth and monetization, choosing the right exchange model early is critical. 2. A Development Partner Should Think Beyond CodeA strong development partner does more than build features. They help you make technical decisions that support your business goals. A reliable partner should guide you on: Scalable system architecture High-performance trading engines Secure wallet infrastructure KYC and AML integration readiness Admin dashboards and platform monitoring If a company avoids discussing scalability, risk, or business impact, it’s a warning sign. 3. Security Must Be Treated as a Core RequirementSecurity is the foundation of any crypto exchange. Even a single security incident can damage credibility and slow user adoption. Before choosing a partner, ensure they address: Hot and cold wallet separation Multi-signature transaction approvals DDoS protection Continuous monitoring and risk controls Professional teams explain how security is designed and maintained not just that it exists. 4. Build for Scalability, Not Just a Fast LaunchMany exchanges fail after launch because they were built only for early users. Your platform should be designed to: Handle increasing trading volumes Add new cryptocurrencies and trading pairs easily Integrate liquidity providers Deliver consistent performance across web and mobile devices Choosing a partner that plans only for launch speed can create costly limitations later. 5. Understand White-Label vs Custom DevelopmentCrypto exchange development usually follows one of two paths:  A trustworthy development partner helps you select the approach that fits your business strategy, not what’s most convenient for them. 6. Post-Launch Support Is Non-NegotiableLaunching the exchange is only the first milestone. Long-term success depends on what happens after deployment. Your development partner should provide: Ongoing technical support Regular updates and performance optimizations Security improvements Feature upgrades as market needs evolve Many founders face problems after launch because support was not clearly defined in advance. 7. Choose a Partner With a Business MindsetThe best crypto exchange development partners act like long-term collaborators. They: Understand crypto market dynamics Design platforms with compliance in mind Anticipate operational challenges Help founders avoid costly early-stage mistakes This business-first approach separates short-lived platforms from sustainable exchanges.

|

«

Return to Development Juan Projects

|

1 view|%1 views

| Free forum by Nabble | Edit this page |